Introduction

Have you ever wondered what would happen to your outstanding debts if something were to happen to you? The burden of debt can be overwhelming for your loved ones, adding financial stress to the emotional turmoil of losing a family member. That’s where credit life insurance comes in. This comprehensive guide will delve into the intricacies of credit life insurance, exploring its benefits and drawbacks, and determining if it’s the right fit for you.

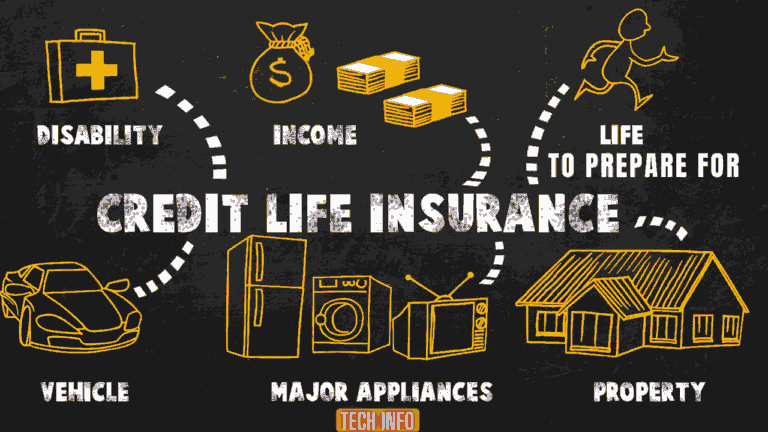

Understanding Credit Life Insurance

Credit life insurance is a specific type of insurance designed to protect borrowers and their families from the financial hardship of unpaid debts in the event of the borrower’s death. It offers a safety net, ensuring that your loved ones won’t have to bear the burden of your liability.

How Credit Life Insurance Works

When you take out a loan, credit insurance is often offered as an option by the lending institution. If you choose to include credit insurance, the premium is typically added to your monthly loan payment. In the event of your untimely passing during the loan term, the insurance company will pay off the outstanding balance of your debt directly to the lender. This provides peace of mind, knowing that your loved ones won’t be left to deal with financial repercussions in their time of grieving. Here are some benefits of credit insurance:

1. Financial Protection for Your Loved Ones

The primary benefit of credit life insurance is the financial protection it provides to your loved ones. By ensuring that your debts are paid off, credit insurance helps safeguard against the burden of unpaid loans falling onto the shoulders of your family members. It preserves their financial security during a time of immense emotional distress, allowing them to focus on healing and moving forward.

2. Quick and Easy Payout

Another advantage of credit insurance is the streamlined payout process. Unlike traditional life insurance policies, where beneficiaries may need to navigate complex paperwork and negotiate with insurance companies, credit insurance pays the benefit directly to the lender. This simplifies the process, ensuring that the funds are efficiently used to settle the outstanding debt.

3. Flexible Coverage Options

Credit life insurance allows you to tailor your coverage to suit your specific needs. You can choose a range that matches the duration of your loan, ensuring that your loved ones are protected throughout the term. Additionally, some policies may include additional coverage options, such as disability or critical illness coverage, providing further security in times of unexpected hardship.

Drawbacks of Credit Life Insurance

1. Higher Premiums: One potential drawback of credit insurance is the higher premiums compared to traditional life insurance policies. The cost of credit insurance is often higher due to factors such as administrative fees and the decreasing benefit amount over time. It is crucial to evaluate your budget and compare premiums across different options to ensure you are comfortable with the ongoing expense.

2. Limited Coverage: Credit life insurance only covers outstanding debts associated with the specific loan it is tied to. It does not extend to other forms of debt, such as credit card balances or personal loans. If you have significant liabilities beyond your loans, it’s essential to consider how those debts will be addressed in your overall financial plan.

Is Credit Life Insurance Right for You?

Determining whether credit insurance is right for you requires a careful assessment of your circumstances. Here are a few factors to consider:

1. Level of Debt: If you have substantial debts tied to mortgages, car loans, or business loans, credit insurance can provide crucial protection for your loved ones. It ensures that these obligations do not become a heavy burden on their shoulders after your passing.

2. Breadwinner Responsibilities: As the primary breadwinner of your family, your unexpected death may leave your loved ones facing significant financial challenges. Credit insurance can offer peace of mind, knowing that your family will be financially secure and able to maintain their quality of life.

3. Existing Financial Security: If you have significant savings or other assets that can be used to settle your debts in the event of your passing, credit life insurance may not be necessary. Consider both your current financial situation and your long-term goals when evaluating the need for this type of coverage.

Conclusion

Credit insurance serves as a safety net, providing financial security and peace of mind for you and your loved ones. While it offers essential protection, it’s crucial to evaluate the premiums, coverage limitations, and your financial circumstances before making a decision. By understanding credit insurance and its implications, you can make an informed choice that aligns with your unique needs and priorities. Safeguard your loved ones today and ensure a brighter, worry-free future for tomorrow.

If you have any questions about this article please contact us at techinfo.